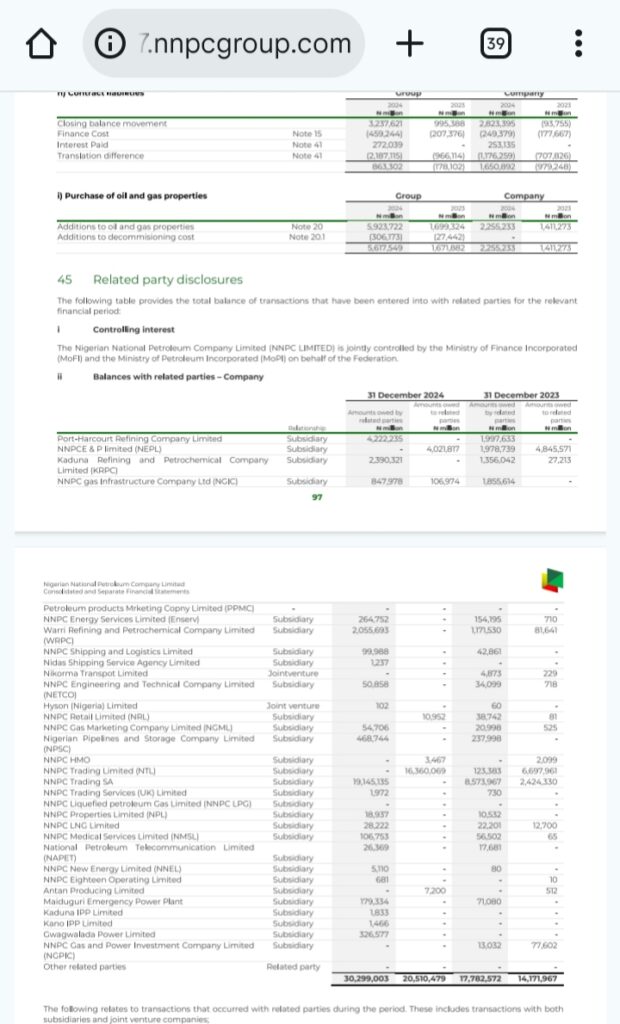

Vibeslyfe review of the Nigerian National Petroleum Company Limited (NNPCL) financial statement as of the year ended December 2024 has shown that the three government-owned refineries currently shut down and other subsidiaries owe the NNPCL N30.2trillion.

The review shows that Port Harcourt Refinery Company Limited owes N4.2 trillion, while Kaduna Refinery and Petrochemical Company Limited owes N2.3 trillion.

NNPCL Gas Infrastructure Limited owes N847 billion, the indebtedness of NNPC Energy Services Limited stood at N264 billion, Warri Refinery and Petrochemical Company Limited owes N2.055 trillion, NNPC Shipping and Logistics Limited owes N99 billion, Nida’s Shipping Service Agency Limited owes N1.2 billion, NNPC Engineering and Technical Company Limited owes N50.8 billion, and Hyson Nigeria Limited owes N102 million.

Others include; NNPCL Gas Marketing Limited with a debt of N54.7 billion, while Nigerian Pipelines and Storage Company Limited owes N468.7 billion.

Also, NNPC Trading (SA) owes N19.1 trillion, NNPC Trading Services (UK) is indebted to the tune of N1.9 billion, NNPC Properties Limited owes N18.9 billion, NNPC LNG Limited owes N28.2 billion, NNPC Medical Services Limited owes N106.7 billion, and National Petroleum Telecommunications Limited owes N26.3 billion.

Also listed are NNPC New Energy Limited with N5.1 billion, NNPC Eighteen Operating Limited with N681 million, Maiduguri Emergency Power Plant with N179.3 billion, Kaduna IPP Limited with N1.8 billion, Kano IPP Limited with N1.4 billion, and Gwagalada Power Limited with N326 billion.

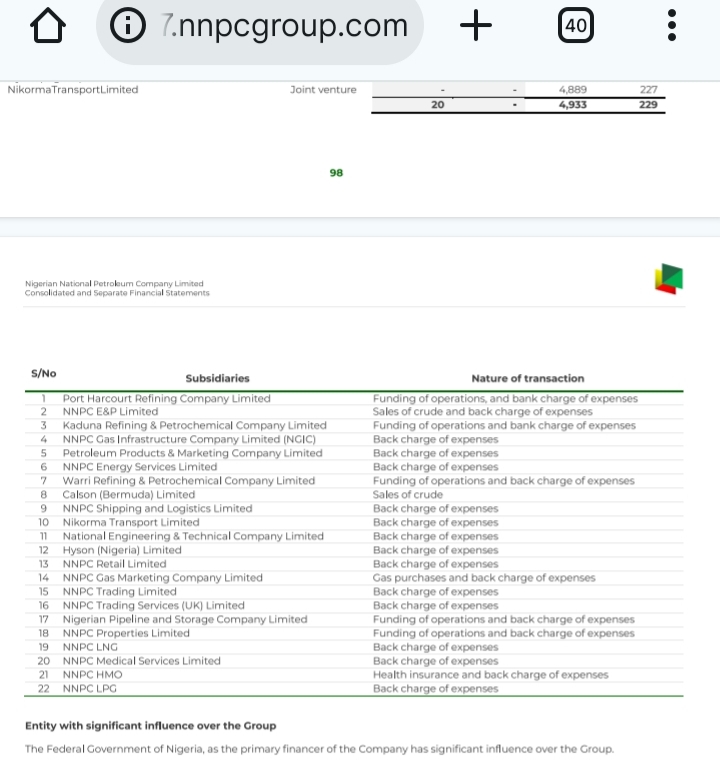

According to the NNPCL, the amounts owed were used for “funding operations, back charge of expenses”.

Earlier, a SaharaReporters’ review showed that four major joint-venture subsidiaries of the organisation amassed high trade and other payable figures expected to be settled on a short-term basis.

According to the breakdown of the financial statement and a review of the current assets and liabilities — which reflect short-term obligations expected to be fulfilled typically within one financial year —.Anoh Gas is indebted in terms of trade and other payables to the tune of N81.2 billion as of December 2024.

Nikorma Transport Limited owes N7.5 billion, West Africa Gas Limited (WAGL) Energy (BVI) is said to be indebted to the tune of N22 billion, while WAGL Energy (Nig) owes N6.9 billion, totalling N117.7 billion owed by the four joint ventures of the NNPCL.

Further review shows that of the four joint ventures, only WAGL Energy (BVI) posted revenue — N520.3 billion as of the year ended December 2024 with a cost of sale of N500.3 billion.

Other joint ventures like Anoh Gas, Nikorma Transport Limited, and WAGL Energy (Nig) made no revenue. However, Anoh Gas incurred N2.1billion on “other administrative expenses” while WAGL Energy (Nig) incurred N65million on the same item.